Trends and challenges in the prevention of money laundering and terrorist financing

- New Complex Priorities – Focus on identification of complex predicate crimes such as Corruption, Cybercrime/Virtual Currencies, Terrorism, Fraud, Human Trafficking, Drug Trafficking, etc.

- AI / ML Adoption - Regulatory agencies are encouraging the use of AI/machine learning to improve the quality of regulatory reports being filed to governments.

- Operations / Staffing - AML organizations have trimmed staff in recent years in anticipation of challenging economies. “Do more with less” through automation.

- Data and Model Governance - Institutions must be able to document, explain and defend strategies to auditors and regulators. “Why did or didn’t you file a SAR/STR on this activity”?

- Hybrid/Cloud Architectures - IT organizations desire a more agile, open and resilient manner for maintaining currency with technology and managing the risk of security vulnerabilities.

Countering Anti-Money-Laudry and financing of terrorism

The total cost of Financial Crime Compliance (FCC) is soaring, with 98% of financial institutions reporting an increase in FCC costs. *

Comprehensive compliance solution on a hybrid/cloud native platform to help financial institutions stay ahead of emerging threats and changing regulations while improving operational efficiency

*Source: LNRS-TLP-True Cost Of Financial Crime Compliance_2023 (1).pdf

Why Comping Anti-Money-Laundry (AML) Solution?

Technology leader according to all relevant analysts (Gartner, Forrester, Chartis, IDC) in several key areas.

An analytics platform that enables data to be transformed into actionable insights at scale, detecting anomalies and fraudulent models.

Comping has successfully implemented AML solutions in 2 different industries.

The Comping AML solution has been implemented in the insurance and payment service provider industries.

This is concrete proof of the functionality, scalability and resilience of the system in a real environment.

Functionalities that guarantee greater operational efficiency

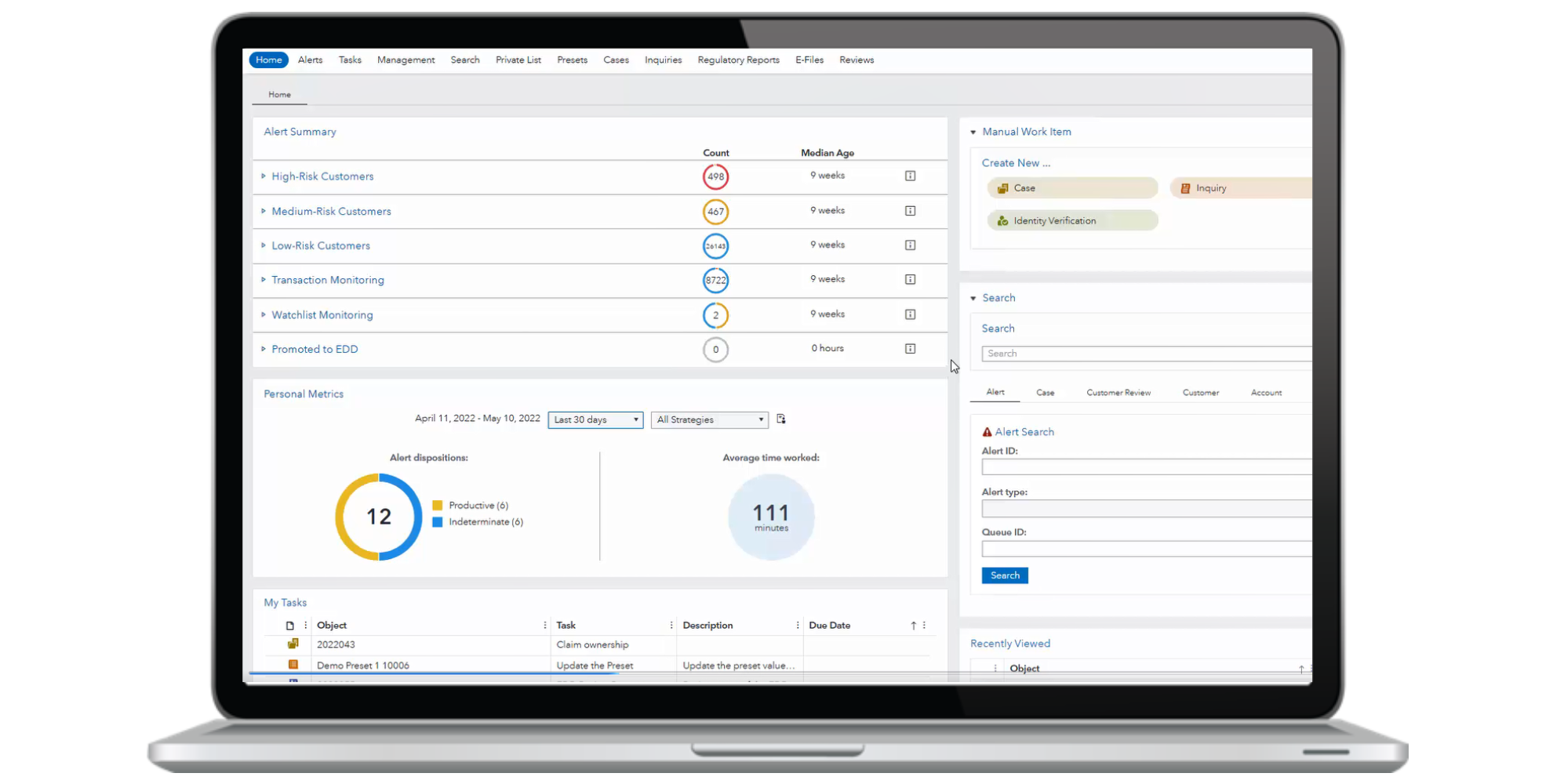

Alert Management

Holistic view of Risk within an intelligently prioritized workbench

Workflow

Automation of tasks and governed business process

Regulatory Reporting

Open regulatory reporting framework for automating filing

Investigator Tools

Network Analytics, Flow of Funds, and Advanced Search

Benefits

Transaction Monitoring

different scenarios according to the types of transactions and specific limits for each type of transaction:

Tracking large transactions, individually and aggregatedly, Transactions with high-risk countries, Circular transactions, A lot of transactions between the individual limit and the aggregate limit, Fuzzy match scenario for monitoring transactions without legitimacy.

Customer screening

Full integration with 4 public lists (EUFS, UN, OFAC and HMT) and with an internal list. Screening based on match type: fuzzy match, exact match, prioritization full vs fuzzy, match at the level of last name or other characteristic or combination of party characteristics

Customer risk assessment

There are 12 different scenarios:

Based on certain attributes of the party or organization (PEP, country, occupation, industry, etc.) Includes related parties or organizations (through ownership or control function)

Customer Due Dilligence (EDD/CDD)

It is determined by aggregated weighted scoring through 4 different risk categories: Party risk (over 40 different risk factors)

- Geographic risk (over 10 different risk factors)

- Transaction risk (over 10 different risk factors)

- Channel Risk