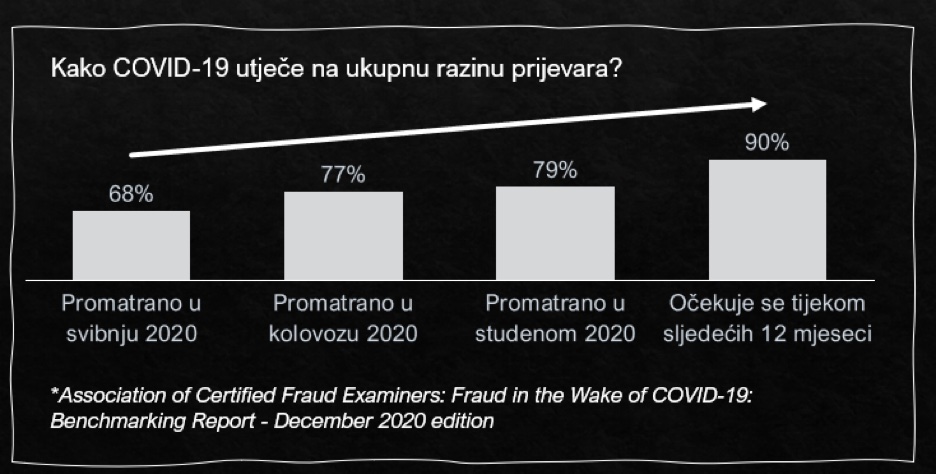

According to a study published by ACFE (the Association of Certified Fraud Examiners), the trend seen in previous studies continues, with an increasing number of participants noticing a rise in fraud after COVID-19.

In November 2020, 79% of respondents said they had recorded an increase in overall fraud levels (compared to 77% in August and 68% in May). Of these, half observed that the increase was significant. Looking ahead to 2021, this trend is expected to continue, with 90% expecting further growth in overall fraud levels over the next 12 months. Some specific fraud risks growing rapidly include payment fraud, identity theft, unemployment fraud, healthcare fraud, insurance fraud, loan and banking fraud, bribery and corruption, and employee embezzlement.

The majority of respondents noticed that the prevention, detection, and investigation of fraud became more difficult after COVID-19. More than three-quarters (77%) stated that fraud prevention and investigations are now more challenging than before. The most common challenges are related to physical restrictions placed on fraud-fighting personnel, including the inability to travel, difficulty conducting remote interviews, and lack of access to evidence.

“Research confirms a significant increase in fraud following the emergence of COVID-19.”

With the increase in fraud risk and changes within certain fraud-risk categories, organizations must ensure that their anti-fraud programs remain effective in the coming year. 41% of the organizations included in the study plan to increase their overall anti-fraud budget.

Almost half (48%) of organizations anticipate increased investments in anti-fraud technologies.

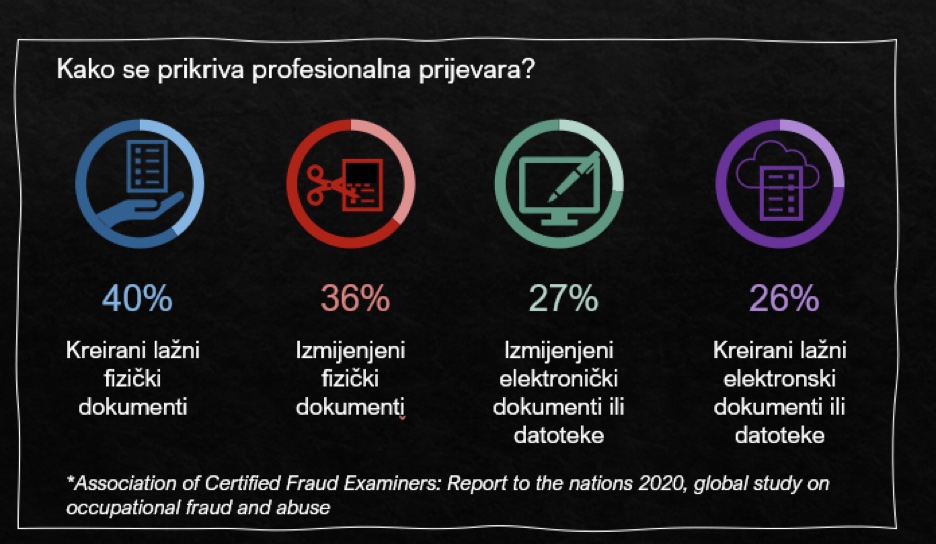

The study confirms that the schemes used by professional fraudsters remain similar. Even with the ongoing digital transformation, which brings processes such as digital payments and technology-based transactions, the schemes and methods used by fraudsters to commit fraud remain the same.

Asset misappropriation, which includes the theft or misuse of an organization’s resources by its employees, occurs in the vast majority of fraud cases (~86%). Corruption, which includes offenses such as bribery, conflicts of interest, and extortion, is on the rise and is present in 43% of cases. Financial statement fraud schemes, in which the perpetrator intentionally causes significant errors or omissions in the organization’s financial statements, are the least common (~10% of schemes).

In one-third of the cases included in the study, the fraudster used more than one primary type of occupational fraud. 26% of fraudsters committed both asset misappropriation and corruption, while in 5% of cases they committed fraud involving all three schemes.

"Asset misappropriation and corruption are the two most significant types of fraud."

For asset misappropriation, fraudsters use several methods to steal funds from their employers.

Fraudulent cash transactions are the most common form of asset misappropriation and also cause substantial financial losses, making this type of fraud a particularly significant risk.

Other high-risk frauds, based on a combination of frequency and financial damage, include unauthorized check and payment issuance, as well as schemes involving the theft of non-cash assets.