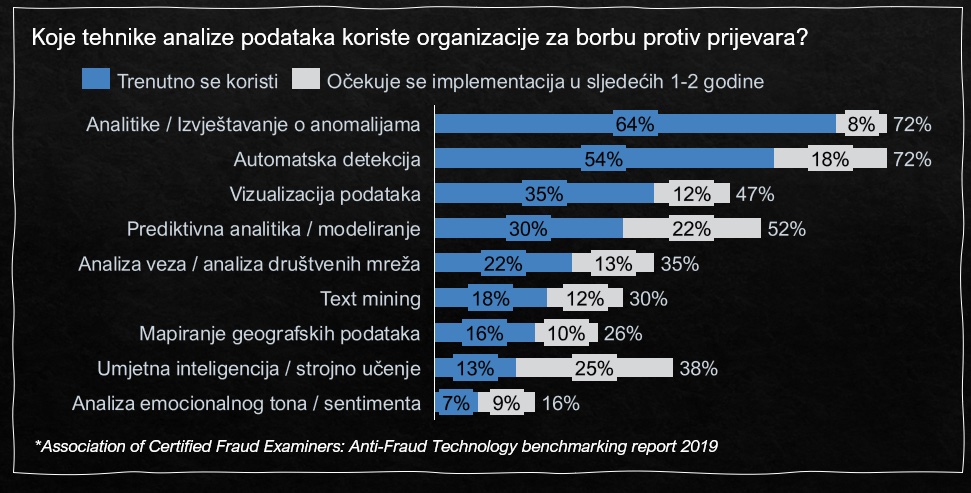

When it comes to fighting fraud, various techniques and technologies can be used for data analysis in order to automatically detect inappropriate behavior.

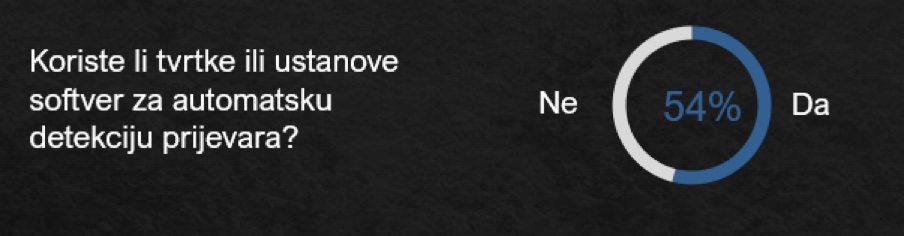

Almost two-thirds of organizations currently use analytics and anomaly reporting, and more than half have implemented software solutions for automated detection of red flags or business rule violations.

Data visualization and predictive analytics/predictive modeling are relatively newer types of analytical techniques that have been adopted or are expected to be adopted by approximately 50% of organizations.

"Automated fraud detection solutions have become indispensable given the growing fraud trends."

For anomaly reporting using analytics and automated detection through software solutions, various sources of structured and unstructured data are used.

The most commonly used sources are: internal structured and unstructured data, public records, legal and regulatory watch lists, social media, other third-party data, and data from connected devices (IoT).

Unstructured data is found outside structured databases and spreadsheets. Examples of unstructured data include text documents, email and direct messages, and image files.

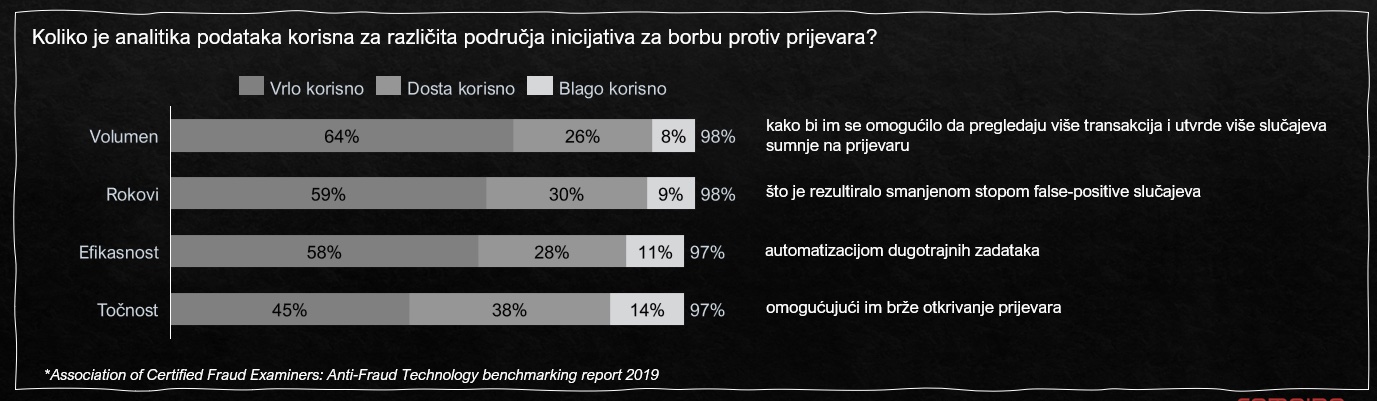

The vast majority of organizations significantly benefit from using analytics in fraud prevention, and 83% to 90% of organizations rate their analytical solutions as very useful or quite useful in each of these four areas.

The greatest benefit achieved relates to volume: 64% of respondents stated that the increased volume of transactions they can review using data analytics is very useful for their fraud-fighting programs.

It is also important to highlight the contribution in the triage step of suspicious cases, where respondents report benefits in terms of timelines and accuracy, resulting in a lower rate of false-positive cases and enabling faster fraud detection and reduced financial loss.

“Research confirms that all organizations using analytical data in their fraud-fighting initiatives report benefits, with approximately 90% reporting moderate or high benefits.”

We can divide anti-fraud technologies into three main categories.

Software for automatic detection of suspicious cases that, through defined scenarios (algorithms), alerts users to cases that exhibit certain characteristics (red flags) which historically have been highly correlated with confirmed fraud. Through scoring, which is calibrated automatically using self-learning functionality (machine learning), it also assists in the triage step so that the most suspicious cases are prioritized for investigation.

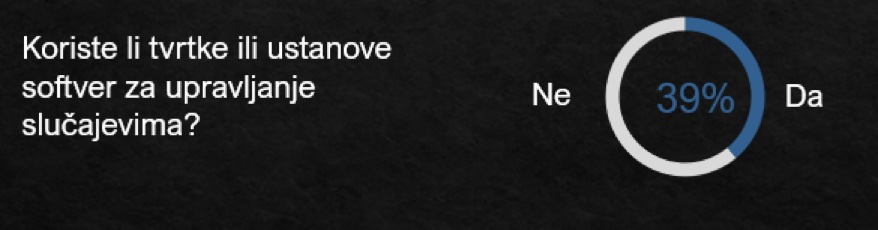

An additional 18% of companies and organizations expect to implement such a solution within the next 1–2 years.

Part of effective fraud case management includes the ability to track and report on the results of all fraud investigations within an organization. The software solution also includes network analytics, data search and discovery (including relationship networks), triage and investigation management, conducting investigations, authorization management, as well as black lists (high-risk clients) and white lists (sensitive clients) of entities.

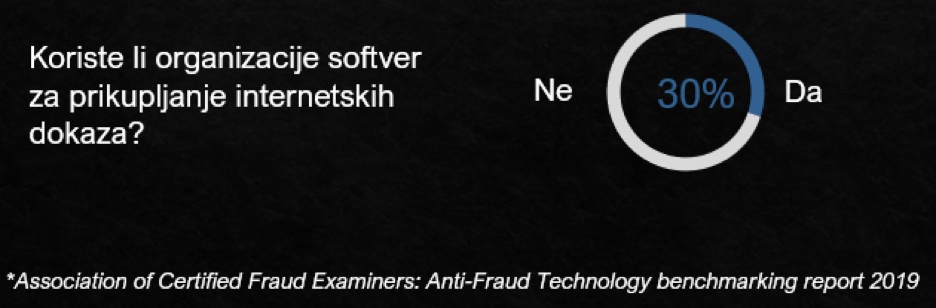

Since 2019, there have been 3.84 billion social media users worldwide. According to a 2017 Robert Half Legal study, 52% of lawyers reported an increase in digital evidence over the previous two years in lawsuits involving posts, images, and data found on social media.

According to ILTA’s 2018 Litigation Support and eDiscovery Survey, 90% of law firms conducted social media discovery that year. Demographics continue to drive significant growth in digital media evidence in litigation. Software solutions enable the storage of evidence in a manner that is accepted in court.