Is the number of fraud cases increasing, or is awareness and detection of them growing? We can only speculate about the answer to this question, but the fact is that detection is on the rise primarily due to the use of new technologies.

Detection is an important step in the fight against fraud because the speed at which fraud is discovered has a significant impact on the financial loss resulting from it. Detection is also crucial for fraud prevention, as organizations can learn and take steps to improve the way they identify fraud, which in turn increases employees’ perception that fraud will be discovered and perpetrators will be punished. The foundation of effective professional fraud detection is understanding the most common methods by which fraud is uncovered.

Despite increasingly sophisticated fraud detection techniques available to organizations, according to an ACFE study, tips have been the most common method of detecting occupational fraud. In recent years, automated fraud detection technologies have been continuously increasing.

The ACFE study shows that detection is increasing in private companies, while stagnating in public companies and government institutions. Public enterprises and government bodies have fewer controls to combat fraud, which makes them more exposed to it. The top three weaknesses in anti-fraud control are the lack of internal managerial controls, the absence of internal audits, and the override of existing internal controls.

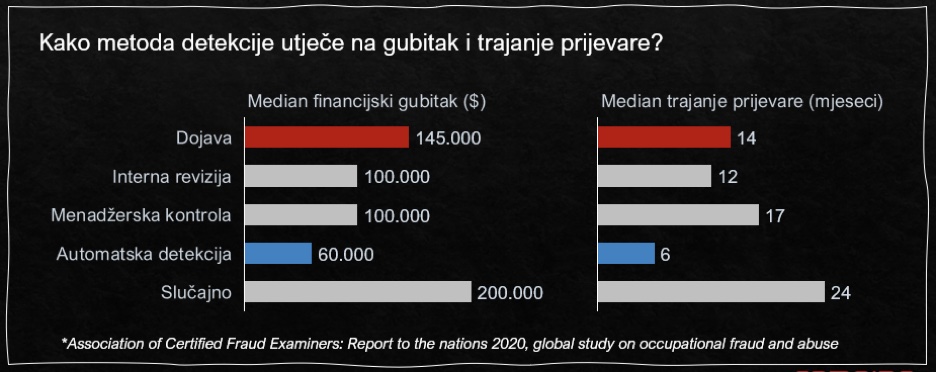

Automatically detected cases had significantly shorter durations and lower financial losses.

Research shows that some fraud detection methods are more effective than others in terms of resulting in lower fraud losses. When fraud is proactively detected (automatic detection and internal audit), it is identified more quickly and therefore causes less damage, while passive detection (random discovery, tips) results in longer schemes and increased financial losses. More than 40% of cases were discovered through tips, so processes for collecting and thoroughly evaluating tips (turning them into proactive rather than passive tools) should be a priority for employees responsible for combating fraud.