SAS in the fight against organized financial crime

Financial industry

2002.

first AML client.

275

global AML clients.

150

global Anti-Fraud clients.

47

Clients in 47 countries.

$1B

investments in artificial intelligence.

SAS is a leader in all key Data & Analytics categories

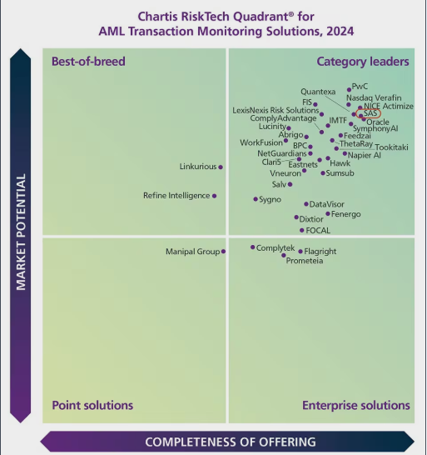

Anti-Money-Laundering

Transaction Monitoring

AI/ML Platforms

Why SAS?

Holistic customer monitoring that provides a 360° view of your client’s risk.

Integrated customer due diligence (CDD) for a complete view of the subject’s risk for due-diligence procedures, as well as for identifying and monitoring beneficial owners and indirect risks.

Know Your Customer (KYC), including customer risk rating and entity resolution.

Model management helps in assessing, monitoring, and managing artificial intelligence techniques with appropriate oversight and controls.

Advanced entity generation and network connections that reveal hidden risks and complex relationships and patterns.

Configurable and extensible for complex monitoring needs, regulatory changes, and transaction monitoring (TM) requirements.

Audit and version control of rules, scenarios, scorecards, and workflows that govern the investigation process.

Integrated investigation and case management provides a centralized platform for reviewing and investigating events and entities.