Trends and Challenges in the Insurance Industry

- Data silos - Ability to view internal and external data to show 360ᵒ risk exposure

- Cost management - Improve combined ratio (claims, acquisition and administration costs), reduction of leakage

- Customer Experience – Protecting the interests of insurers with minimal disruption to the customer experience

- Technology optimization – Integration of data sources, application of advanced analytics (underwriting, claims, risks)

- Regulatory Compliance - Adhering to ever-changing regulations in a proactive manner

- Connected Investigations – Enabling collaboration between fraud teams to detect fraud patterns

Comping solution - Preventing fraud in claims handling

The total cost of insurance fraud (non-life insurance without health insurance) is estimated at more than $40 billion per year.

It is estimated that 10% of all property and casualty insurance claims globally contain some element of fraud.

Why Comping Anti-Fraud Solution?

Technology leader according to all relevant analysts (Gartner, Forrester, Chartis, IDC) in several key areas.

An analytics platform that enables data to be transformed into actionable insights at scale, detecting anomalies and fraudulent models.

Comping has successfully implemented anti-fraud solutions in 4 different industries.

Comping anti-fraud solution has been implemented in market leaders in industries such as electricity distribution, insurance, the national pension system and payment service providers.

This is concrete proof of the functionality, scalability and resilience of the system in a real environment.

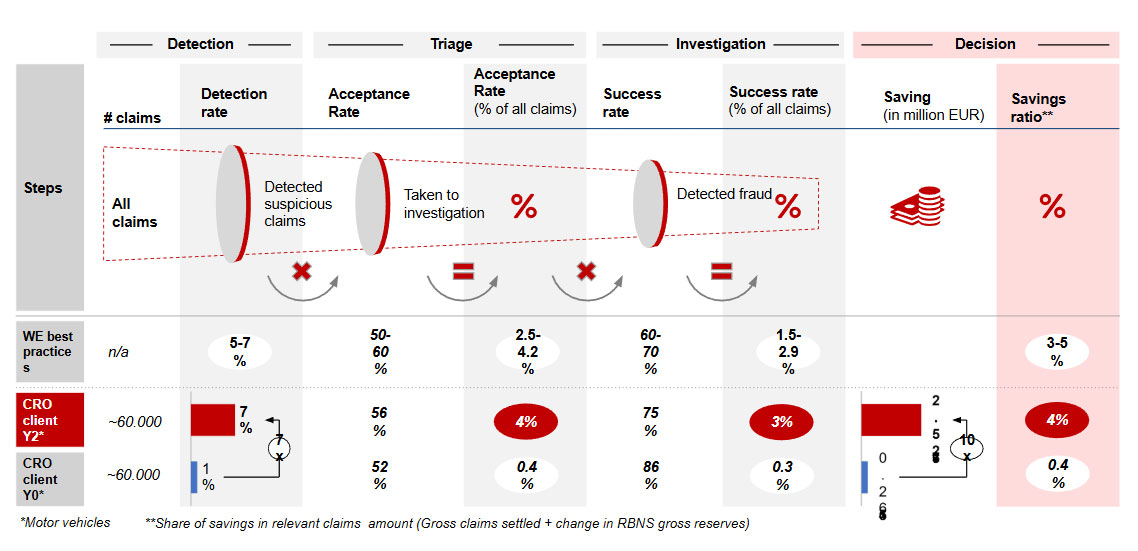

Quantified benefits for the market leader insurance company

Detection

more detected cases, as a result of 50+ advanced analytical scenarios that create alerts that then go into triage (detection rate 7%, before 1%)

Triage

more cases are taken over for the investigation, and this is enabled by specially developed 7 user interfaces through which he has access to information about claim events, the insured, policies, claims, vehicle, injured party at the click of a button... (4% acceptance rate, before 0,4%)

Investigation

better success rate of investigations, which was previously at the level of about 0.3%, and with the use of the Comping anti-fraud system is about 3% of all claims, and is the result of advanced analytical detection and advanced user interfaces in the triage phase that enable the rejection of false-positive cases

Saving

greater savings resulting from advanced analytical detection, triage and investigation through which resources are directed for subsequent assesments and the investigations, where the success rate of the investigation is then very high (about 75%), which affects the growth of direct savings

Example of a client from the Croatian insurance market

The implementation of the solution resulted in a 10x increase in savings (+2.2 million EUR) in just 2 years.